August 10, 2023 • 5 min read

Battery materials: understanding global policy and regulation

What impacts will the US Inflation Reduction Act and the European Union's Critical Raw Materials Act have on the global battery value chain?

“The move to limit global CO2 emissions requires a complete rewiring of the energy system,” says Dave OudeNijeweme, Senior Director, Battery Materials – Growth.

“For the battery market specifically, where demand continues to grow because of the global boom in electric vehicles (EVs), battery materials producers have a lot of opportunities.”

For example, the British Government’s 10 point plan for a ‘green industrial revolution’ – announced in November 2020 – included phasing out the sale of new petrol and diesel by 2030, with new cars and vans needing to be zero emissions by 2035. This, and other similar legislation across the world, could see the batteries market reach US$410bn in size by 2030, according to McKinsey & Company.

“Governments are keen to protect national interests, jobs, and economic growth, so they are both increasing support for domestic battery industries and introducing new legislation,” continues OudeNijeweme.

“However, the failure of Britishvolt in the UK shows that this is not a silver bullet for capitalizing on such rapid growth. There are still more than 300 gigafactories under construction worldwide. More than 200 are in China, which shows most Western nations have fallen behind in this market. And they need to respond.”

The Inflation Reduction Act response

In the US, there has been an attempt to regain some control of the market. President Biden’s Inflation Reduction Act (IRA) encourages large investments into domestic energy production, which will have major impacts on EVs and batteries – specifically relating to critical mineral and battery component requirements.

According to Goldman Sachs, the IRA lowers the US domestic battery cost curve by US$45/kWh.

“Automakers are required to demonstrate that 40 percent of the extraction or processing of critical minerals occurs in the US, or a country that has a free trade agreement with the US,” explains OudeNijeweme. “In addition, 50 percent of the value of battery components in an EV vehicle need to be manufactured or assembled in North America. And these percentages will increase over time.”

The EU response

In response to the IRA, the EU has introduced the Critical Raw Materials Act (CRMA). On 1 February 2023, the European Commission published its Green Deal Industrial Plan, with the aim of increasing the competitiveness of EU net zero industries.

A joint-debt-funded ‘European Sovereignty Fund’ to subsidize green businesses across the EU was bolstered with a ‘Net Zero Industry Act’. This provides a simplified regulatory framework to produce technologies deemed vital for meeting climate goals, including solar, wind, batteries, heat pumps and carbon capture and storage.

Energy Monitor’s Dave Keating adds wider context.

“The World Bank predicts that there will be a 500 percent increase in global demand for critical raw materials between now and 2050, and this will cause price spikes and a global supply race. And one technology that is heavily dependent on critical raw materials is batteries.”

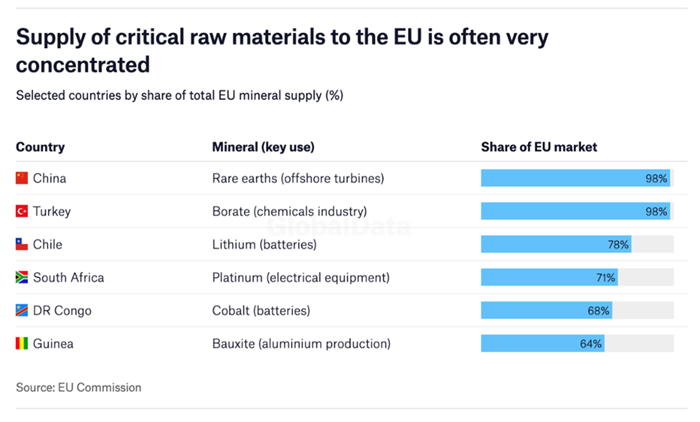

Globally, China is the largest exporter of 19 of the 30 critical raw materials determined by the EU as being the most vital. Those materials are, however, also found in many other countries, including within the borders of the EU itself.

“Other countries, such as Indonesia, Australia, Canada, and Chile – with significant resources like nickel, copper and other valuable raw materials – are keen to grab more of the value add, with a recent example being Chile’s proposal to nationalize its lithium industry,” says OudeNijeweme.

“A carbon threshold may also be introduced as early as 2027, helping the EU to produce more environmentally sustainable batteries, and lower emissions transport. It also includes measures such as a battery passport to demonstrate where the materials come from and the embedded carbon they contain,” continues OudeNijeweme.

The investment shortfall

For the batteries industry, standardization is key to expanding battery production quickly and affordably, as explored in our From Ambition to Reality thought leadership series with Princeton University. But it’s not yet reflected in projects on the ground.

While capital to deliver hundreds of gigafactories exists in principle, it’s still falling short of net zero ambitions. Capital also needs to be better deployed across engineering and construction to deliver innovations and assets at pace that will enable a net zero world.

Standardization can enable a faster transition from fossil fuels

For the battery market, the number of pre-cursor, active material and recycling facilities – plus the investment required to feed the demand for EVs – is significant.

“Standardization is the consistent solution,” says OudeNijeweme. “Designing one, then building many identical battery assembly facilities is the answer to this challenge. Concepts exist that would enable the battery materials industry, and therefore the world, to transition to an electrified future more quickly.

“The benefits of a ‘design one, build many’ approach include lower overall capital investment levels, increased speed to market, and easier operation and maintenance,” continues OudeNijeweme. “New technologies will also lower operating costs and enable easier upgrades, translating into lower investment risk.

“Increased standardization and more efficient, strategic planning frees up precious engineering, construction and supply chain capacity. This will enable a significantly faster transition from fossil fuels to environmentally sustainable electrification.”

Download the paper

To find out more about the opportunities and challenges for battery material producers, download the whitepaper.