April 09, 2025 • 4 min read

Tapping into new revenue streams for ethanol producers: how standardized e-Methanol plants can increase profit

We are helping lower the cost and time required for ethanol producers to start making e-Methanol, unlocking revenue potential as demand for the fuel grows.

Our collaboration with Topsoe allows us to provide standardized plant designs that can accelerate regulatory approval and fabrication.

Ethanol producers in the United States (US) Midwest have a new and fast growing revenue opportunity: rising demand for low carbon fuels. A key driver of this demand is the global maritime industry’s desire to quickly transition toward fuels with a lower carbon intensity (CI), which is mirrored by growing interest from players in the aviation industry.

Many ethanol producers know they can unlock this new revenue stream using their captured biogenic CO2 byproduct for e-Methanol production, instead of sequestering it. However, many have been hesitant, as building the necessary facilities has generally taken up to six years from the initial business decision. This has been due to lengthy, costly and complex processes that can often clutter the path forward.

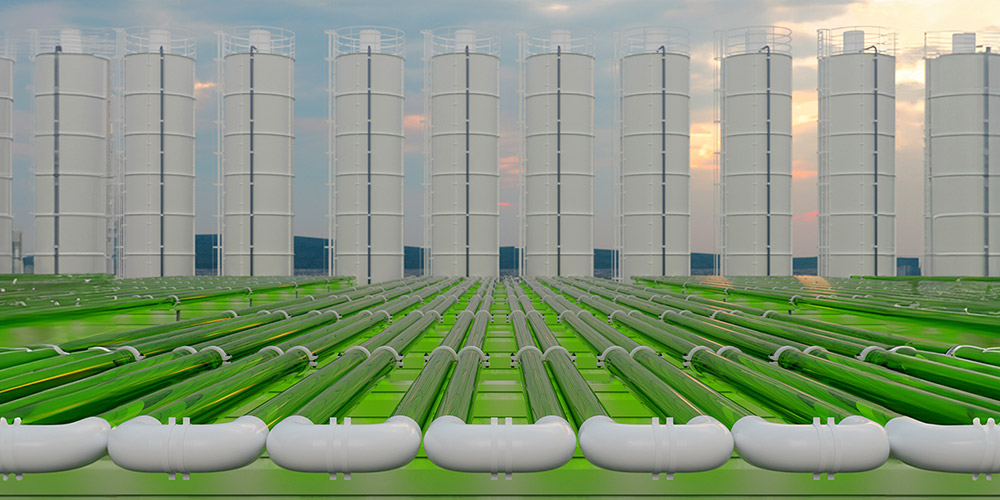

But this situation is changing. We’ve announced a collaboration agreement with Topsoe, a global leader in renewable fuel technology, to design standardized and modular e-Methanol plant solutions. With pre-configured plants, bioethanol producers can reach the design and delivery stages in far less time, bringing forward new revenue from e-Methanol.

Regulations are fueling demand for e-Methanol

Meanwhile, the European Union’s FuelEU Maritime Regulation requires an 80 percent reduction in the greenhouse gas intensity of maritime fuels by 2050, starting with a two percent reduction in 2025. The regulation is technology-agnostic, but there is a sub-requirement for ships to use two percent of renewable fuels of non-biological origin (RFNBO) per year from 2034 (Regulation (EU) 2023/1805).

E-Methanol fuel – produced by combining green hydrogen with CO2 – is well positioned to help achieve these objectives. Using biogenic CO2 and green electricity, we can achieve very low product CI. This is attractive for shipping companies as they need to purchase less fuel to meet their IMO and FuelEU Maritime obligations while also helping comply with RFBNO. As such, demand for the fuel is projected to grow in the coming years.

As the demand for e-Methanol increases, the ethanol industry faces its own market shift. The uptake of electric vehicles is impacting fuel markets. As a result, long term projections suggest that demand for road transport ethanol in the US and Canada will fall over the next decade.

This is another reason that ethanol producers are exploring new revenue streams via low CI fuel production and also carbon capture for sequestration. However, sequestration requires extensive pipeline infrastructure, which may experience prolonged project delays or cancellations due to regulatory approvals and jurisdiction claims.

This has been seen with the canceled Heartland Greenway pipeline project, for example, which was to pass through five Midwestern US states. By comparison, e-Methanol production offers a more straightforward and economically viable alternative.

Standardized and modular e-Methanol plant designs have clear advantages

These designs can accelerate progress toward a final investment decision, plant fabrication and a new revenue stream for ethanol producers – incorporating Topsoe’s state of the art e-Methanol synthesis technology from the outset. We will provide producers with a complete engineering package to achieve this result, including modular component specifications and relevant costings.

The core components of these archetype plants will have already undergone many of the rigorous safety evaluations required for plant approvals. As such, ethanol producers will save on the significant time and expenditure typically required to gain regulatory approvals for traditional plant development, provided they do not deviate too far from the standard designs.

By co-locating new facilities adjacent to existing bioethanol plants, producers can further simplify logistics and avoid the need for costly pipeline infrastructure. This is particularly true for Midwestern US producers, which have excellent access to fuel transport systems. Liquified e-Methanol can be transported to ports via rail or barge, which is an easier and more cost-effective solution than piping biogenic CO2 across jurisdictions for sequestration.

Accelerated timelines for a faster return on investment

These producers also have other revenue opportunities to consider as they assess the potential benefits of e-Methanol production. As we’ve previously highlighted, the aviation industry is also seeking lower carbon fuels.

As such, opportunities remain for Midwestern US producers to explore alcohol-to-jet pathways for their bioethanol, as well as the use of low carbon methanol as feedstock for methanol-to-jet SAF production. Our expertise in providing Sustainable Aviation Fuel (SAF) support over many years can also help turn those ideas into reality.

What’s ultimately clear is that ethanol producers can better future proof their operations and potentially lift profitability with a few strategic decisions based on projections across major industries, including maritime and aviation.